News archive

2025

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

I work at ING

My pension has started

I worked at ING

Will ING CDC Pensioenfonds increase pensions on 1 januari 2024?

28-08-2023

Last year, inflation in the Netherlands was high. That's why our pension fund increased your pension by 4.58% at the beginning of 2023. We refer to this as indexation. Prices will continue to be high this year as well, and market research bureau GFK recently announced that the predicted decline of prices in supermarkets is not materialising. Unfortunately though, we might not be able to increase pensions in early 2024. Why is that?

How does indexation work?

Once a year, in the final quarter of the year, our pension fund determines whether it will be able to increase pensions. That depends on two things:

- Our policy funding ratio. This is an indicator of the pension fund's financial position;

- The inflation rate. To determine the inflation rate, we take the consumer price index (CPI) for households in the Netherlands as published by Statistics Netherlands (CBS).

Policy funding ratio

At the end of July 2023, our policy funding ratio was 127%. According to regulatory requirements, this means we would be allowed to increase pensions (partly). The legally required minimum for indexation is a funding ratio of 110% or more, while full indexation is allowed from about 140%. Pension funds switching to the new pension system are even allowed to increase pensions (partly) from 105%.

Price index

Statistics Netherlands (CBS) measures price levels in the Netherlands and, based on that, it publishes its price index once a month. Our pension fund takes the period running from October to October to determine the overall change in price index. Last year, the change in price index for that period was 16.93%.

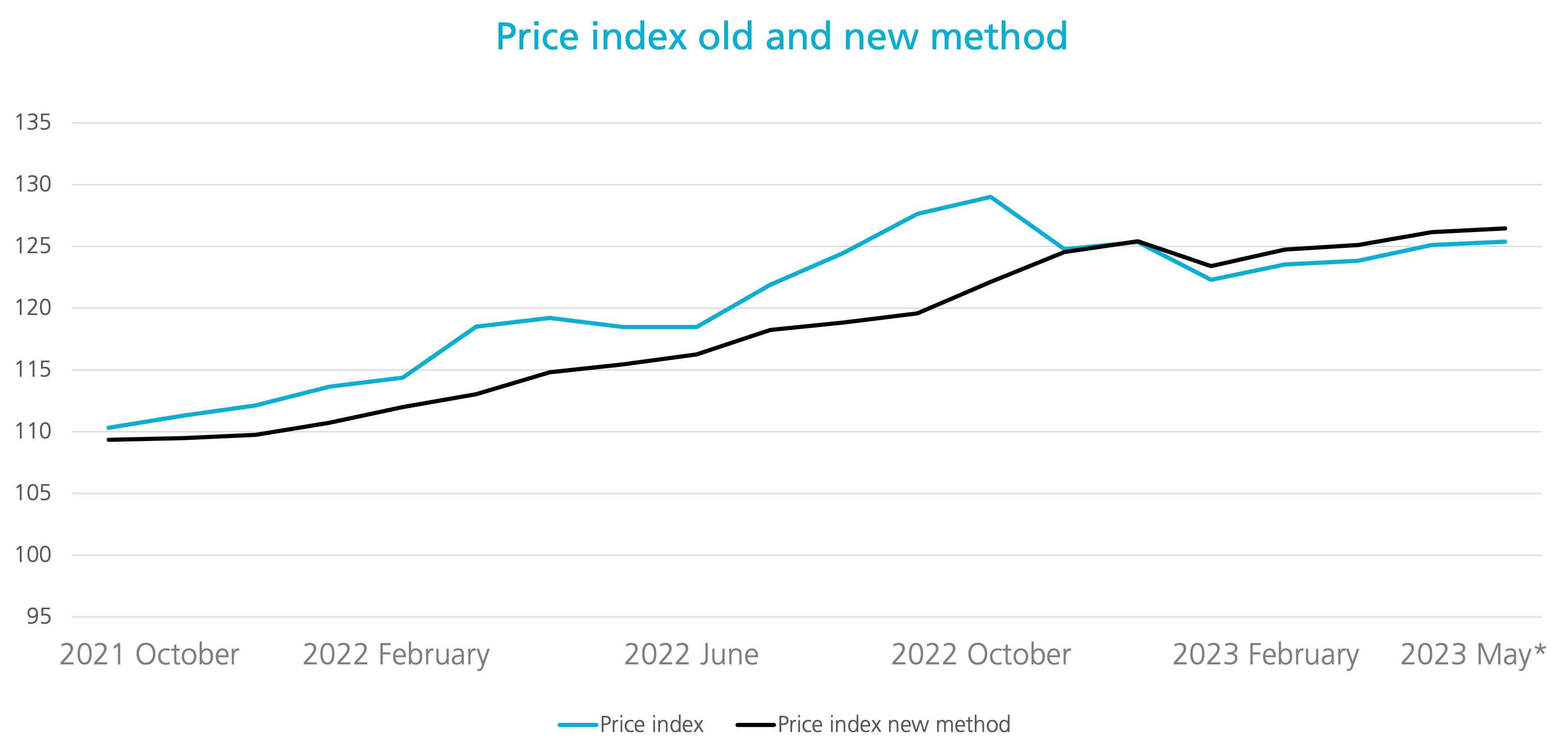

Inflation currently negative according to price index

The price index for October 2022 was 128.98. In July 2023, the price index was 127.14. In other words, it was lower than in October 2022, which means inflation is currently negative. In that situation our pension fund is not allowed to increase pensions. On the other hand, pensions are not lowered when inflation is negative.

Why is inflation currently negative?

The CBS price index includes prices of all sorts of products, ranging from milk to cars and from computers to energy. With regard to energy prices, the situation last year was exceptional. Energy prices rose steeply and that rise was immediately included in the CBS’ calculations for its price index.

However, not everyone was actually affected by the price hikes at that time, because many people still had energy contracts with low prices. This means the price index for last year October was in fact too high.

The CBS has come to the conclusion that the method it uses to measure prices can lead to odd peaks. That's why the CBS adjusted its method with effect from July 2023. The graph below shows what the price index would have been if the CBS had used the adjusted method last year. As you can see, eventually the level of the price index is more or less the same under both measuring methods. However, the way in which the index changes over time is different.

What does this mean for you?

As a result of the ‘old’ measuring method, everyone got a higher indexation rate with effect from 1 January 2023 than they would have if energy expenses had been measured differently.

The indexation rate for 2023 will depend on the outcome of the ‘new’ price index in the coming months. If the price index stays below the index for October 2022, we will not be able to increase pensions on 1 January 2024.

Share: