News archive

2025

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

I work at ING

My pension has started

I worked at ING

What if conditions are favourable or adverse?

26-05-2020

What could happen to your pension if the economy performs well, or poorly, over a long period of time? From this year, your Uniform Pension Overview (UPO) will include a forecast of your pension benefits under different economic circumstances. This new information is a response to new regulatory requirements for pension administrators such as ING CDC Pensioenfonds. Late last year, the Dutch government's pension website mijnpensioenoverzicht.nl started presenting pension forecasts as well.

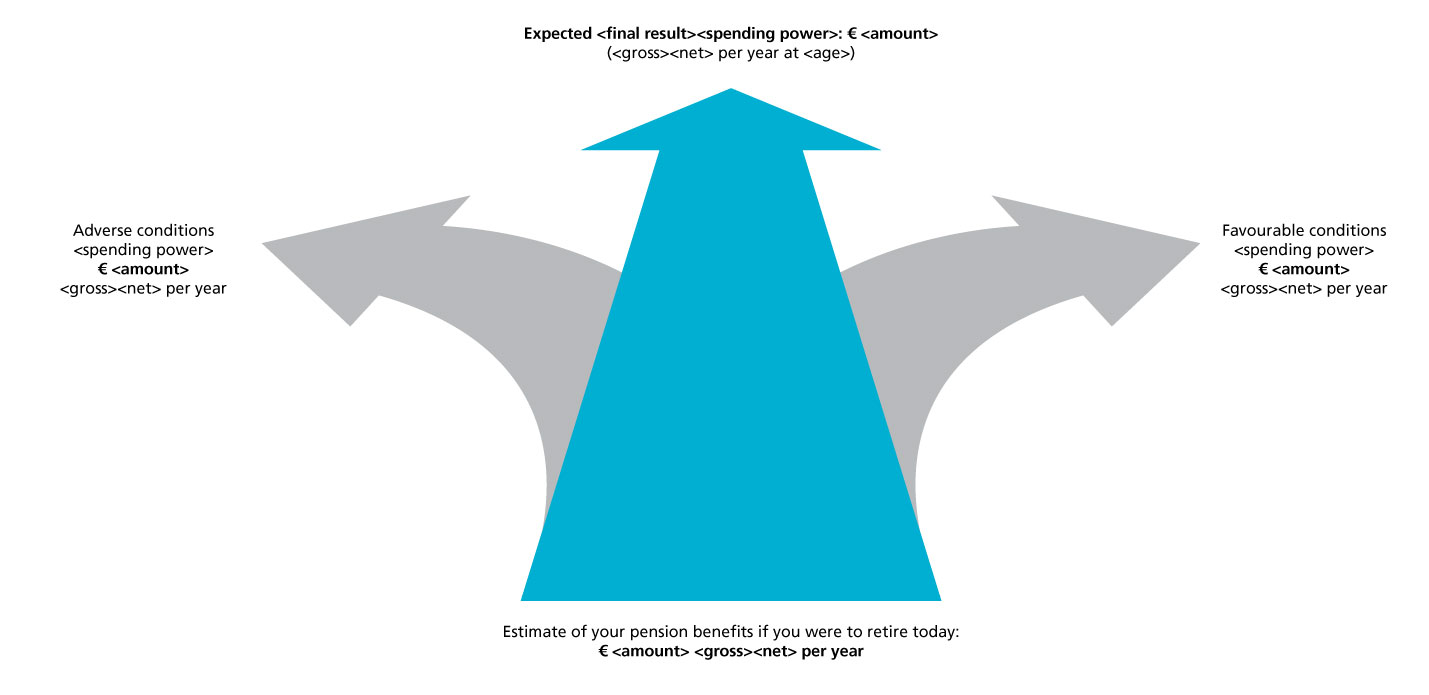

Your UPO 2020 shows a forecast of the pension you'll get from ING CDC Pensioenfonds in the event of favourable or adverse economic conditions in the future. The information is shown in a diagram with three arrows that start from a single point. The amount at the bottom of the diagram is not an estimate – it is the amount of pension you’ve built up in the pension fund so far. The three amounts at the top of the diagram are an estimate of the pension you will likely receive in different scenarios. See the example below. The forecast is based on your situation as at 31 December 2019.

The amount at the bottom of the diagram

The amount at the bottom is the pension you’ve built up so far. If you were to stop building up your pension today, this is the amount of pension you would receive annually, on a pre-tax basis, for the rest of your life. The website mijnpensioenoverzicht.nl shows this amount based on the assumption that you will retire from work on the date that your Dutch state pension starts paying out.

The amounts at the top of the diagram

At the top, you’ll see three amounts. These amounts are estimates of the pension you will likely receive in different scenarios. An important assumption for all three amounts is that you will continue working until you reach the pension fund's standard retirement age (67 years of age) and continue to build up your pension under the currently prevailing provisions of the pension plan. If you were to retire early, your pension benefits would be lower.

The supervisory authority has published a set of different future scenarios that the pension fund is required to apply. In one scenario interest rates, return on investment and inflation are favourable. In another scenario, these conditions are adverse. All pension funds and insurance companies are required to make calculations based on the same future scenarios. We have calculated your pension based on these scenarios.

- The expected final result

This is the amount shown at the top centre of the diagram. It is the amount of pension you could reach under current conditions. Based on the different scenarios, there’s a 50% probability that your pension will be lower and a 50% probability that it will be higher than this amount. - If conditions are favourable

The arrow at the right of the diagram shows the amount you could reach if the economy performs well in the future. Based on scenario calculations under current conditions, the likelihood that your pension would be higher than the amount at the right is minimal (5%). - If conditions are adverse

The arrow at the left of the diagram shows the amount you could reach if the economy performs poorer than expected. Based on scenario calculations under current conditions, the likelihood that your pension would be lower than the amount at the left is minimal (5%).

Important note: the amounts shown in the diagram are estimates, based on a set of assumptions (which are required under current regulations). These amounts will be adjusted from year to year following economic developments, modifications in the underlying assumptions, a possible change in your salary, changes in the pension plan, etc. The amounts shown (and the underlying percentages) are estimates - as a participant, you cannot derive any rights from these amounts.

FAQ

What would make conditions favourable or adverse?

Interest rates

If interest rates were to rise, the pension fund would be able to lower its reserves for future commitments and it would be more likely that we'd be able to increase pensions. If interest rates were to drop, however, we would have to enlarge our reserves and it would be less likely that we’d be able to increase pensions.

Investments

We invest pension contributions for your future pension. This is not without risk. We don't know in advance how much return we’ll get on our investments. At times, investments could generate low returns or even make losses.

Rising or falling consumer prices

If consumer prices rise, the value of your pension declines. This is because you’ll be able to purchase less with the same amount of money. We have included the impact of consumer prices on the future spending power of your pension in our forecast. The estimated amount of your future pension is adjusted for this. If prices are expected to go down, the amount is adjusted downward (slightly).

What is the difference between Mijnpensioenoverzicht.nl and the UPO?

Your UPO 2020 has a new feature: it includes a forecast of your pension in the event of favourable and adverse conditions. The outcome shows an estimate of the amount of pension you’ll receive in pre-tax annual amounts. The Dutch government's website www.mijnpensioenoverzicht.nl shows a forecast of your overall pension benefits, including pensions in other pension plans and your Dutch state pension (AOW), in net monthly amounts.

What can I do with the estimated pension amounts?

You can use the amount in the middle of the diagram to figure out if your estimated pension benefits will be enough to live comfortably when you retire. The other two amounts give an indication of your pension under favourable or adverse economic conditions.

Your pension will not suddenly decline to the amount on the left of the diagram. If the economy performs poorly over a long period of time, your expected pension (the amount in the middle of the diagram) will decline gradually. That's why it makes sense to check the status of your pension from time to time (at least once a year), so you’ll know in which direction your pension is developing.

How likely is it that I’ll receive the lowest amount?

In 5% of the scenarios, the outcome was lower than the amount under adverse conditions. Based on these scenarios, the probability that you’ll receive more than the lowest amount is 95%.

How likely is it that I’ll receive the middle amount?

The middle scenario is shown at the top of the diagram. In 50% of the scenarios, you’ll get less than this amount and in 50% of the scenarios you’ll get more. The main point is that it shows the direction your pension is heading if circumstances are favourable or adverse over a long period of time.

How likely is it that I’ll receive the highest amount?

In 5% of the scenarios, the outcome was higher than the amount under favourable conditions. Based on these scenarios, the probability that you’ll receive less than the highest amount is 95%.

When are conditions favourable?

Conditions are favourable if the economy performs much better than expected. That could mean returns on investments are better than expected or interest rates go up - we don’t know if these situations will occur. The arrow to the right shows you what would happen to your pension in under favourable economic conditions.

When are conditions considered adverse?

Conditions are adverse if the economy performs much worse than expected. That could be a future situation in which returns on investments are lower than expected or interest rates drop below expected rates. We don’t know if these situations will occur. The arrow to the left shows you what would happen to your pension in under adverse economic conditions.

Have your already retired?

If you have already retired, the Dutch government's website mijnpensioenoverzicht.nl shows you an estimate of your pension if economic conditions are favourable or adverse over the next ten years. You will see this estimate from the day you start receiving your Dutch state pension (AOW). Before you start receiving AOW, your pension is shown based on the assumption that your retirement will start on the same date as your AOW.

Is your expected final result lower than the amount you are currently receiving? That means economists are expecting consumer prices to rise, which would cause the spending power of your pension to decline. In other words, you wouldn't be receiving less pension, but you’d be able to buy less with it. The expected final result gives you an indication of how much you’d be able to spend ten years from now.

Why doesn’t the forecast include surviving dependants pension?

These regulations apply only to old age pension.

Share: