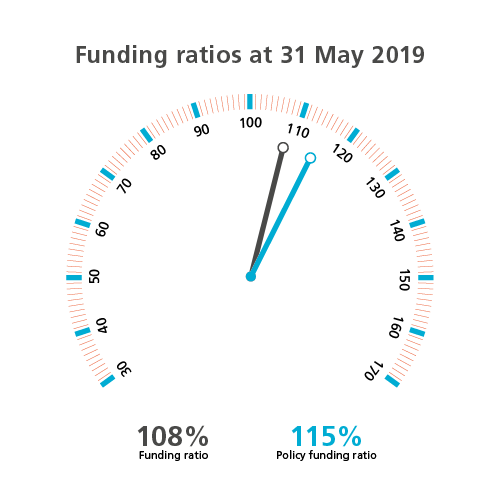

ING CDC Pensioenfonds’ funding ratios as at 31 May 2019 are known. The funding ratio is 108% and the policy funding ratio is 115%.

The funding ratio indicates whether the fund’s financial position on a certain reference date is adequate enough to pay out pensions accrued now and in the future. The higher the funding ratio, the better the fund’s financial position. A funding ratio of 100% indicates that the fund’s financial position on the reference date is adequate enough to pay out pensions that have been built up in the fund. The funding ratio as at 31 May 2019 amounts to 108%. This is a decrease of 4% compared to April 2019.

The policy funding ratio is equal to the average of the funding ratios for the preceding twelve months. With effect from 2015, the policy funding ratio provides the fund with a benchmark for making policy decisions, such as determining the amount of headroom available for indexation and the adequacy of the fund’s reserves. By taking the average for the preceding twelve months, important decisions no longer hinge on the funding ratio prevailing on any given date. The policy funding ratio as at 31 May 2019 thus amounts to 115%. This is a decrease of 1% compared to April 2019.

Since 30 September 2015, ING CDC Pensioenfonds has been faced with a reserve deficit. This means that the pension fund’s policy funding ratio has fallen below the funding ratio required by law. Consequently, the pension fund has had to submit a recovery plan to DNB. The funding ratios of May 2019 do not impact the recovery plan.

The pension fund publishes its funding ratios on or around the 15th day of each month. The graph below shows the situation as at ultimo May 2019. Click here to see funding ratio developments in 2018 and 2019.