News archive

2025

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

I work at ING

My pension has started

I worked at ING

Better outlook for your pension

25-05-2022

After several ‘lean years’ for your pension, times are changing for the better! This is because interest rates are rising. The pension fund would like to give you a financial update, so you know what to expect.

In recent years, the pension fund has had to manage your pension amid challenging market circumstances. The combination of a fixed contribution and extremely low interest rates was not beneficial to your pension accrual. And the pension fund was unable to increase your pension to keep up with rising prices.

You may have heard about it in the national media. Interest rates have risen sharply in recent months, and this is allowing pension funds to give a more positive outlook than before. This applies to ING CDC Pensioenfonds as well.

Indexation

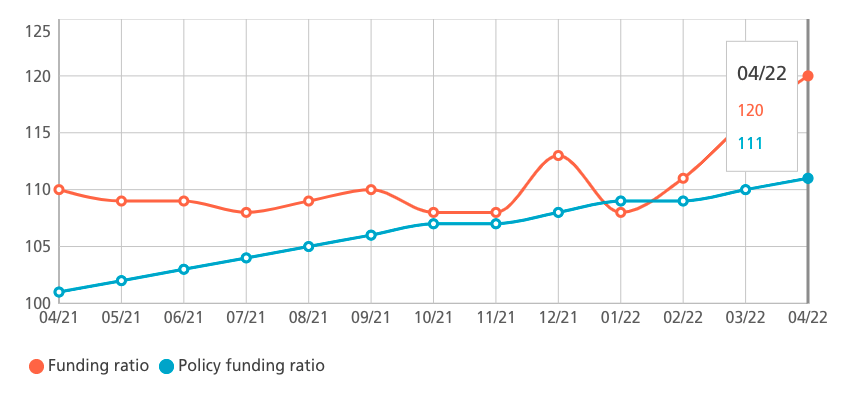

As a result of the rising interest rates, the pension fund’s funding ratio has gone up from 108% in January to 120% in April 2022. A higher funding ratio means the pension fund's financial situation has improved significantly. And there’s also more room to partly increase your pension so it keeps up with inflation (indexation) for the year 2022. And that's good news. Everyone benefits, whether you’re currently employed by ING, were employed in the past or are already retired.

Regulations

The ability of the pension fund to increase your pension to keep up with inflation in a given year depends on Dutch laws and regulations. The most important factor is the pension fund's policy funding ratio, which is equivalent to its average funding ratio for the preceding 12 months. Your pension can only be increased if the pension fund’s policy funding ratio is higher than 110%.

Every year, Statistics Netherlands (CBS) measures the percentage by which consumer prices rise in the Netherlands. If NN CDC Pensioenfonds can increase your pension, it will apply the CBS's percentage.

Based on the pension fund's policy funding ratio as at 30 September 2022, the board will decide whether any indexation can be granted. As at 30 April, the fund’s policy funding ratio was 111%. ING CDC Pensioenfonds will inform you after September 2022.

Pension accrual

ING and the trade unions aim for pension accrual at the maximum rate allowed under Dutch tax law. The accrual rate is recalculated every year. In 2022 the percentage is 1.784%. Every year, the pension fund assesses whether the fixed pension contributions are sufficient to build up your pension at the maximum level allowed for that year. If the contributions are insufficient, the pension accrual rate is reduced. Unfortunately, this has been the case in previous years.

When will you know?

Interest rates at 30 September 2022 will determine how much pension ING CDC Pensioenfonds will be able to accrue on your behalf in 2023. While a reduction of the accrual rate is still expected, it will be less (or much less) than in 2022 due to the rising interest rates. The fund will inform you after September.

Stay up to date

Pension is a rapidly evolving topic and the pension fund is constantly adapting. To stay up-to-date on developments regarding the financial situation of ING CDC Pensioenfonds and, more importantly, the implications for your pension, please read our newsletters.

Share: