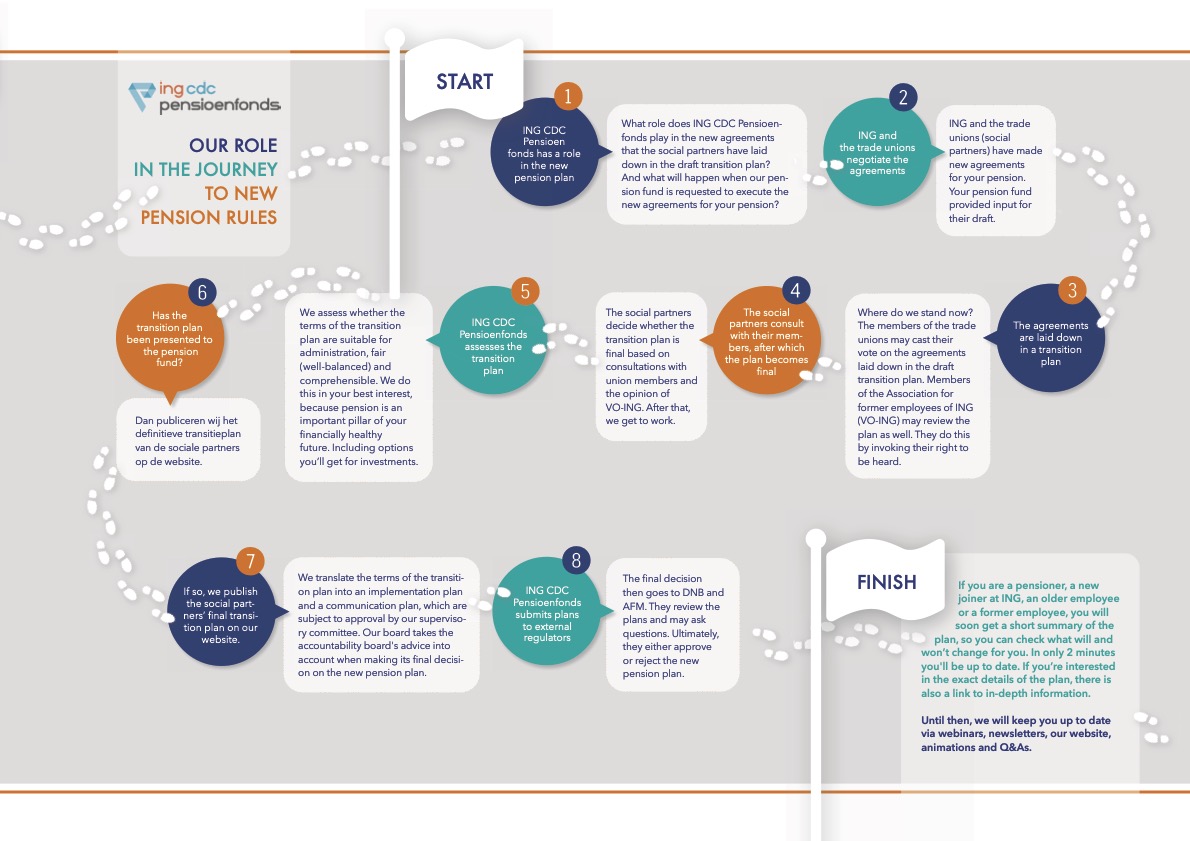

What will happen when our pension fund is requested to execute the new agreements for your pension? After reading the information below, you’ll know what you may expect from us, as well as when and why.

ING and the trade unions have agreed on the terms of the new pension plan

ING and the trade unions (social partners) have made new agreements for your pension. These agreements have been laid down in the draft transition plan. Your pension fund provided input for that draft, but it was ultimately the social partners’ role to make the choices set out in the transition plan.

The agreements have been laid down in a transition plan

Where do we stand now? The members of the trade unions will be given the opportunity to cast their vote on the agreements laid down in the draft transition plan. Members of the Association for former employees of ING (VO-ING) will also get the opportunity to review the plan. They do this by invoking their right to be heard.

Social partners will consult with their members before the plan becomes final

The social partners will decide whether the transition plan is final based on the trade unions’ consultations with their members. They will also take into account the advice given by the Association for former employees of ING. After that, your pension fund will get to work. Our first step will be to post the transition plan on the website.

Clickhere »to open or download this image.

Clickhere »to open or download this image.

What will ING CDC Pensioenfonds do with the transition plan?

We will assess whether the terms of the transition plan are suitable for administration, fair (well-balanced) and comprehensible. We do this in your best interest, because pension is an important pillar of your financially healthy future. You will also have several new options, for instance with regard to investments. That's why we carefully assess the transition plan. Moreover, it is our duty to formulate clear terms for a number of important matters, such as rules for investment risk, the risk sharing reserve and the protection of pension benefits.

After that, our plans will go to the regulator

We will translate the terms of the transition plan into a concrete implementation plan and a communication plan. To inform everyone as thoroughly as possible about the implications of the new pension rules for existing pension rights (i.e. the transferral of existing pension rights to the new system). The accountability board (VO) has power of consent with regard to these plans. Our board will also take into account the advice given by the accountability board when making its final decision. If the pension fund's supervisory board approves the board's decision, the final plans will be sent to the external regulators.

The Dutch central bank (DNB) and the Netherlands Authority for the Financial Markets (AFM) will each need to issue a statement of no objection

The final decision will then be sent to DNB and the AFM. DNB will review the implementation plan, while the AFM will review the communication plan. They can ask questions as part of their review. Ultimately, DNB will or will not issue a statement of no objection. If there is no objection, we will be allowed to start implementing the new pension plan.

Are you retired? Are you employed by ING? Or are you a former employee?

If so, you will receive a short summary of the plan so you can check what will change for you and what will remain the same. In only 2 minutes you'll be up to date. If you’d like to know the exact details of the plan, there is also a link to in-depth information.

Until then, we will keep you up to date via webinars, newsletters, Q&As on our website and animations.